Why Mergers fail and how to make yours a successIntroduction

Why Mergers fail and how to make yours a successIntroduction

This blog is based on a presentation I gave a few years ago to government departments and private companies. It is equally relevant to a merger between companies or within departments from the same organisation. Its intention is to stimulate a debate on the key aspects of planning and living with a merger.

My background is that I started as a Civil Engineer undertaking technical work for a privately owned UK consultancy employing 450 staff. After 30 years in the industry and prior to setting up HDB Associates, I was working in a leadership role for a US fortune 500 company employing 90,000 people, all without moving office!

I have been through eight major “mergers” having been sold three times and purchaser five times. This has given me an inimitable perspective of the good the bad and the ugly of corporate life.

Mergers

An acquisition is the process of acquiring a company to build on strengths or weaknesses of the acquiring company. A merger is similar to an acquisition but refers more strictly to the amalgamation of two firms on roughly equal terms into a stronger single company.

Companies like to refer to takeovers as “mergers” as they sound more inclusive and welcoming than an “acquisition”.

My first contention is that there is no such thing as a merger.

![]() Discussion Points

Discussion Points

Is there always a buyer and a seller?

Are there always winners and losers?

Motivations

For a “merger” to materialize you need a buyer and a seller, they will both have a motivation for wanting the transaction to take place.Possible motivations of a buyer:

• World Domination

• Spare Cash

• Internal pressure to expand

• External pressure to expand

• Add Services

• Add Geographical locations

• Economies of Scale – efficiency

• Remove competitionPossible motivations of a seller:

• Retiring Owners

• No Cash

• Internal pressure to expand

• External pressure to expand

• Add Services

• Add Geographical locations

• Economies of Scale – efficiency![]() Discussion Point

Discussion Point

Do the buyer’s and seller’s motivations need to be compatible for the merger to be successful?Considerations

It should be obvious that the more research undertaken prior to a merger the more successful it is likely to be. There are four key areas where as much as possible should be known about the two companies involved:

• Strategy

• Infrastructure – Estate, IT, Systems etc

• Processes

• People

These are often overlooked as the buyer assumes it knows about themselves and at a high level the company to be “merged”:

![]() Discussion Point

Discussion Point

Mergers rarely fail due to issues with Infrastructure and Process – Strategy and People are key?

Strategy

The following issues should be considered prior to any merger:

• Vision – what did we do – what will we do

• Culture – values and behaviours – align or impose

• Domestic ownership vs International ownership

• Private vs Partnership vs floated company

• Ethics governance risk etc.

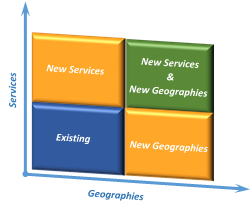

The key issue to be considered is how the combined company will generate its sales and revenue. The two figures below show a simple analysis that can be undertaken to determine if 1 + 1 >= 2 or, as more often the case, less than 2!

The blue segments represent the coverage of the buyer in terms of revenue and sales, the minimum requirement is a fit where the seller’s coverage builds on the buyer’s blue segments, while adding new services, geographies, clients and markets sector depicted by the orange segments. If this is the case then the green segments, the ultimate goal can be achieved.

If, however, the majority of the seller’s coverage is in the blue segments it is likely that the combined company will have more mouths to feed but less market share.

If, however, the majority of the seller’s coverage is in the blue segments it is likely that the combined company will have more mouths to feed but less market share.

In simple terms don’t buy a company that is a mirror image of yourself, unless the combined company can create opportunities to expand into larger projects and the overhead synergy savings outweighs the inevitable loss in sales and revenue.

![]() Discussion Point

Discussion Point

Can a merger succeed if the buyer’s and seller’s coverage of services, geographies, clients and market sectors are similar?

People

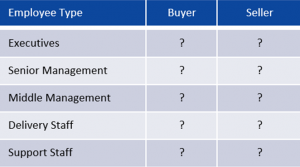

While most of the required information for a merger, to be successful, are facts that can be collected, arguably the most important factor, the people, is much more subjective.

The first steps are to understand the different types of people involved and what their needs may be.

Categorising the employee types and assigning their needs will allow a plan to be formulated.

The buyer needs to:

The buyer needs to:

• Plan

• Understand the status quo

• Have an open mind

• Listen

• Create a sense of ownership and involvement

• Act decisively & quickly

• Communicate

• Then communicate some more

The seller needs to:

• Have an open mind and engage

• Listen

• Accept change

• Or leave!

![]() Discussion Point

Discussion Point

Get the people issues right and everything else will fall into place?

How to succeed

Dale Carnegie:

“You can make more friends in two months by becoming more interested in other people than you can in two years by trying to get people interested in you”

“People will support a world they helped create”

Mergers (acquisitions) or Re-structuring is expensive

“Your key assets go home at night and you need them to come back in the morning”

![]() HDB Associates Ltd

HDB Associates Ltd

HDB Associates provides Management and Technology Consultancy services and can help you plan and deliver a successful merger.

Many mergers fail to deliver their expected returns because of misplaced loyalty or preconceived ideas, meaning the combined strengths of the two organisations are not realised. We provide independent advice free from any constraints or corporate politics.

Using our combined experience of over 100 years in corporate life we have a shared desire to provide consultancy services with an unparalleled level of service for you and your stakeholders.

Much more information can be found on our website www.hdba.co.uk

David Bennison

Director

david.bennison@hdba.co.uk

07767 346029